By Andrew Bilsdon, Delivery Lead – Altis Sydney

Following on from my recent webinar, The Value of Data and Information, I have written this blog to pick up on some of the key points.

This blog focuses on some of the key topics, they are:

- The Problem

- Discussing Data Value

- Measuring Value

The Problem

Quantifying the Value of Data and Information has traditionally been very difficult. The consequence is that it can be a struggle to concisely answer questions like:

- What do we mean by value?

- Why do you need a Data Platform, what is the value?

- What is the ROI of building a Modern Data Platform?

- How will it improve insights and what are they worth?

- Why will there be efficiency gains if you invest in data?

- How does delivering self-service support a user to discover insights?

- What are the consequences of poor-quality data or data security?

- From an accounting position, what sort of asset is data?

- How do I?

- Apply a dollar value to a data asset if I want to sell it separately?

- Apply a dollar value if data is sold with a business?

- Write a business case to justify the creation of a data asset or platform?

- Communicate effectively with others to demonstrate Worth and Usefulness of:

- BI/Analytics department

- Data Stewards

- Etc

After all, if we cannot answer these questions how do we measure our contribution when servicing a customer, whether they are internal or external?

Discussing Data Value

So what do we mean by value? A concise definition I use is:

“Value is the regard that something is held in, based on the worth or usefulness of something”.

It is important to note that, we are not talking value of data when sold for nefarious reasons. Quite legitimate examples include:

- Sales of an organisation that has built a Data Platform (e.g. a mortgage company merges with a large bank)

- Delivery of a Data Service (e.g., Bloomberg, LinkedIn)

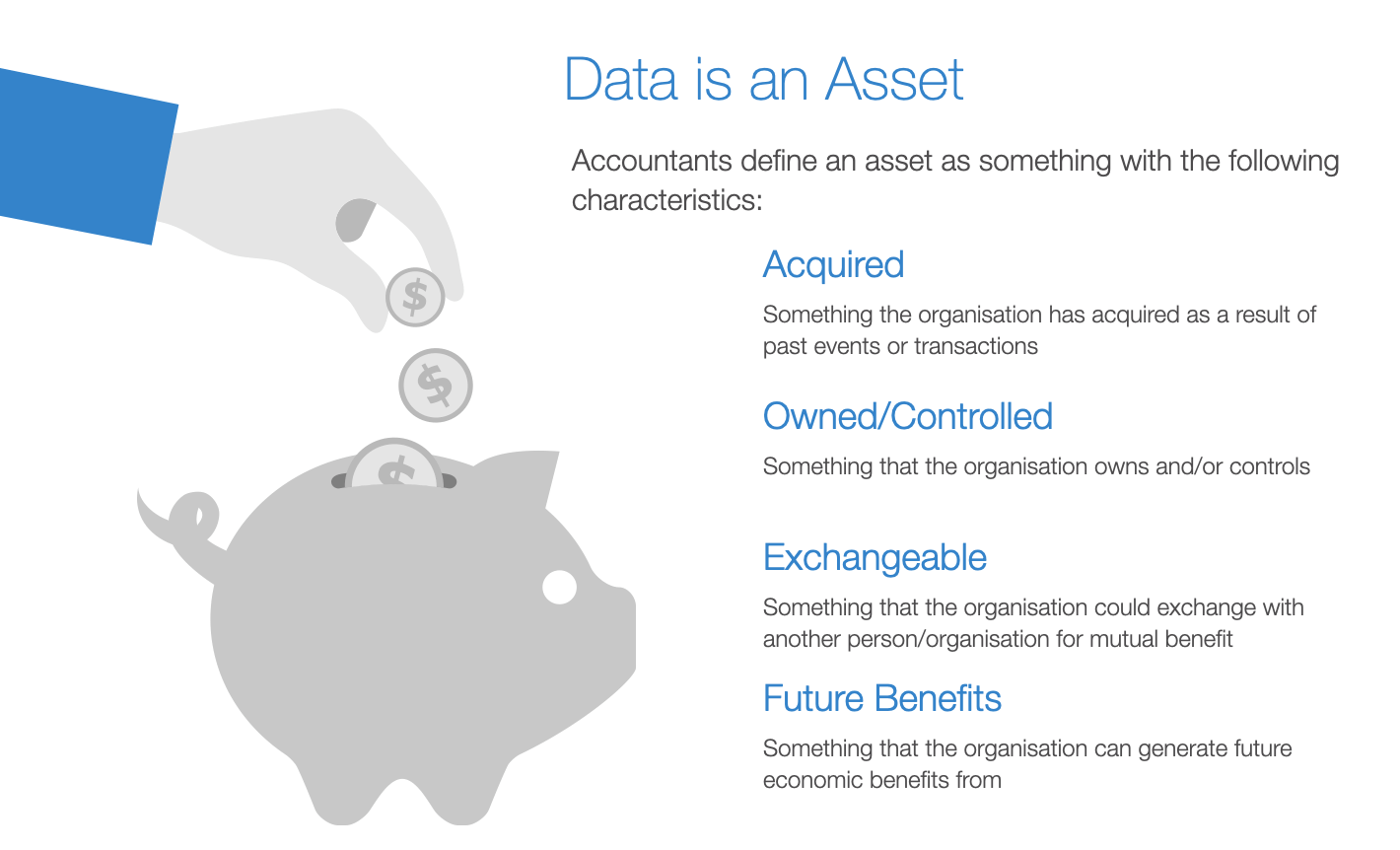

Finally, when we discuss data, we also often use the phrase “Data is an Asset”, so let’s explore that.

The following diagram covers a set of attributes an Asset has:

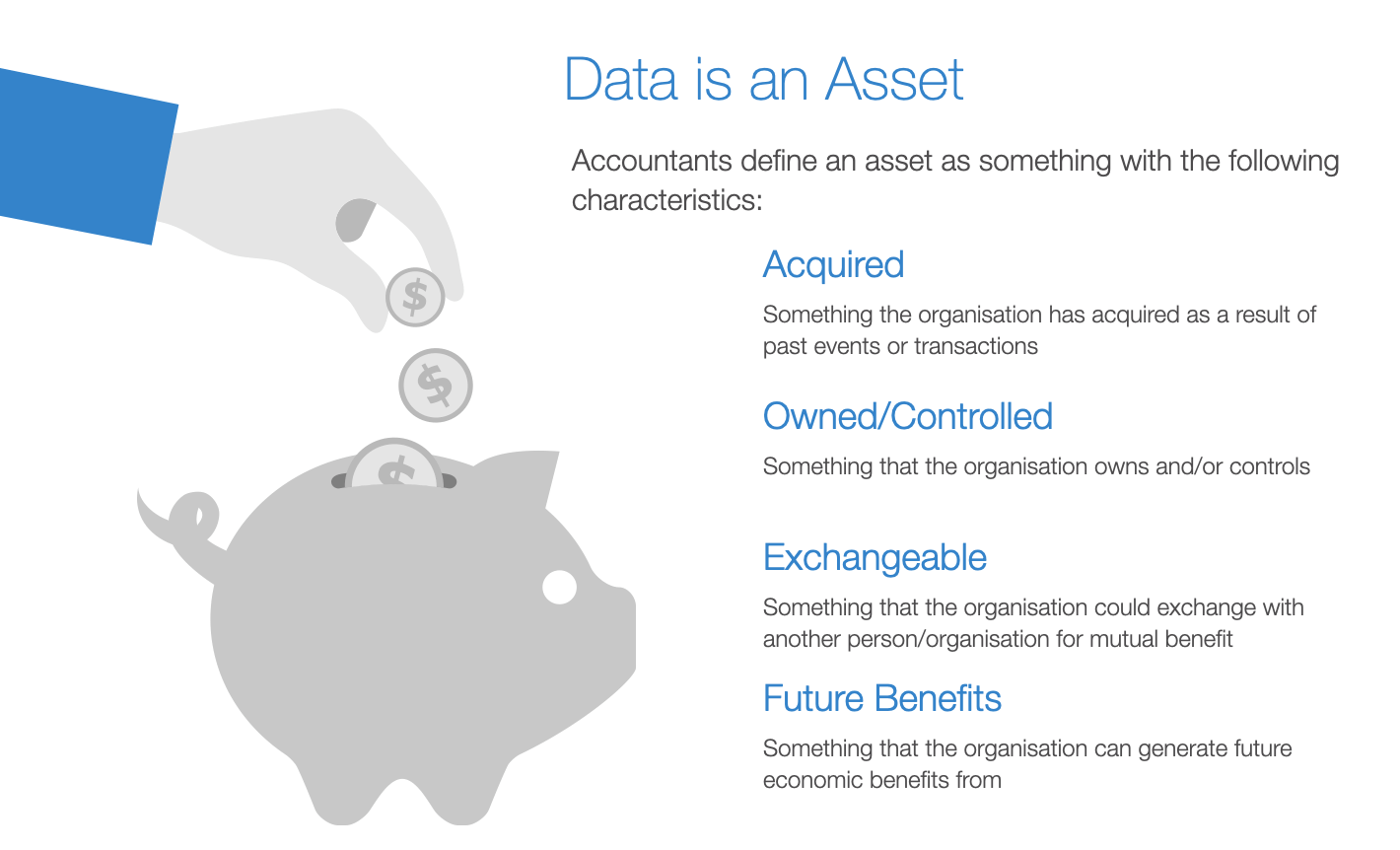

However, it is far more nuanced than this, there are two Asset types, these are:

For an Asset to be classified as Intangible, it needs to meet these test

- The Asset is not physical.

- It is technically feasible to complete the intangible asset so that it will be available for use or sale.

- The business has the intention to complete the intangible asset and use or sell it.

- The business can use or sell the intangible asset.

- If the intangible asset will generate probable future economic benefits.

- The availability of adequate, technical, financial, and other resources to complete the development and to use or sell the intangible asset; and

- Its ability to measure reliably the expenditure attributable to the intangible asset during its development

Data is therefore a candidate for the Intangible Asset category after considering these tests.

Measuring

Now that we have an asset classification, let’s investigate how we can quantify how valuable this intangible asset is. This is vital, as it will arm you when you:

- Ask for the budget to:

- Create it

- Add to it

- Maintain it

- Setting a price to sell it

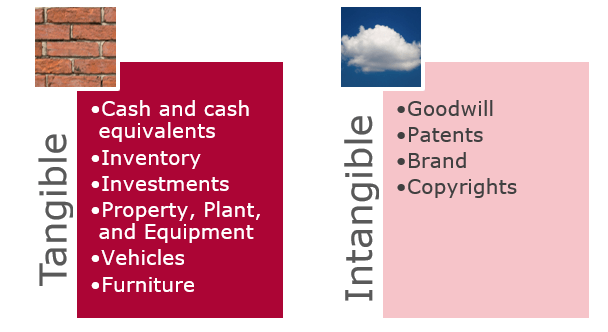

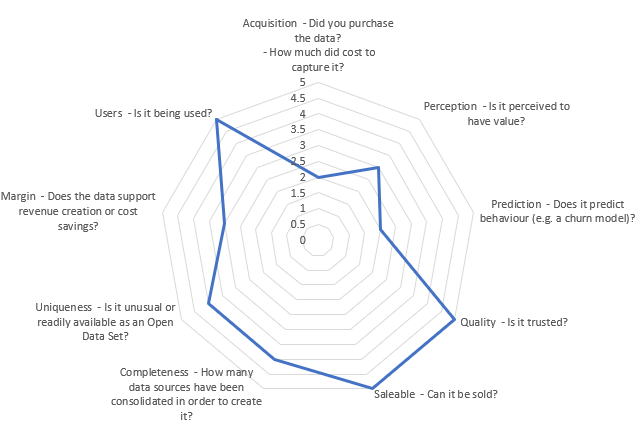

The dimensions of value are varied and the relative weighting of them will depend on the scenario. The following diagram is an example of the common ones I encounter:

The beauty of having a set of dimension to value the asset means we can also tactically add value by, for example, improving the quality, adding datasets to increase completeness, etc.

Outcomes

The following are tangible examples where data can be demonstrated to have value.

- Utilities that use failure modelling to reduce over maintenance of equipment.

- Banks who use churn modelling to proactively intervene to prevent Customers from leaving.

- Universities who proactively intervene to prevent Students from discontinuing their studies.

- Retailers who increase sales by targeting customers to cross-sell.

- Construction companies who have reduced the cost of reporting each month by 1.8 FTEs through the creation of a multi-source dataset,

- Marketing departments that reduce mailout costs by increasing the quality of the postal address data, therefore, reduced the number of returned documents.

- Banks who value their enterprise data warehouse as an intangible asset when they are sold.

- Airlines that:

- Reduce waste costs through more accurate catering plans.

- Increase revenue through better stacking of aircraft storage.

Hopefully, this blog has created some interest, if so, you can watch the full webinar below or contact me via our NSW office.

Interested in watching more of our past webinars? View our previous Free Data & Analytics webinar recordings here.